Sugar-Based Drinks Now Taxed by Sugar Content, Not Fixed Rate

The Federal Tax Authority (FTA) has announced a major revision to its excise tax statute that will take effect as soon as January 1, 2026. A significant change to sweetened drinks businesses that conduct or have conducted business in the UAE has been a reform that is a categorical shift from a flat rate to a tiered structure where tax liability is directly related to a good’s sugar content.

It’s not a minor adjustment for entrepreneurs but a proactive consideration of a product strategy, administrative procedures, and competitive standing.

Understanding the Tiered System

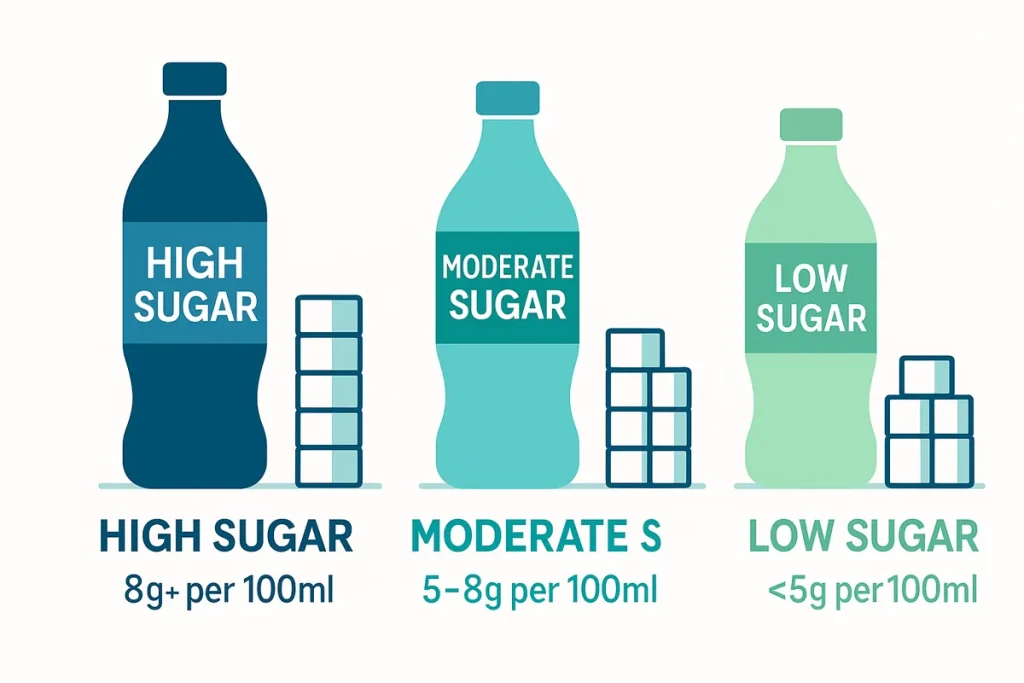

Existing system taxes all sweetened drinks equally at a flat 50% of the retail price. New framework replaces it with a tiered tax scheme based on the total sugar content per 100ml. It is a critical consideration for your business planning. Total sugar content is measured by natural sugars, sugars added and other sweeteners but explicitly excludes artificial sweeteners. New categories are:

- (a) High Sugar Category: Foods containing 8 or more grams of total sugar per 100ml.

- (b) Moderate Sugar Category: Foods with 5 grams to less than 8 grams of total sugar per 100ml.

- (c) Low Sugar Category: Less than 5 grams total sugar per 100ml.

Industry’s biggest news is that only artificially sweetened beverages will now be taxed with a nil excise duty. On top of that, a distinct tax category for carbonated drinks is being eliminated and their taxability is now being determined solely by their sugar content.

Administrative Compliance Becomes Critical

New regulations introduce a critical administrative requirement. To register or alter a beverage on FTA’s portal, you must submit a certified laboratory report that demonstrates the sugar content of a product.

Businesses should be cognizant of a critical default rule: if a lab report is not filed, a product will be pre-assigned to the high-sugar classification. It may then be taxed more heavily and retailed lower than a competitive level. Tax paid in excess is deductible or refundable later only after submission of a required lab report, a process that can be both time-consuming and complex. The FTA has strongly advised businesses to begin reviewing their product formulations and engaging with accredited laboratories immediately to ensure a smooth transition.

Strategic Implications for Business

There is a unique opportunity here for entrepreneurial CEOs. Shifting your portfolio into a lower taxing bracket with a potential increase to profitability and share gains is possible by redesigning your products to be lower sugar. There is also a good innovation and diversification driver here with a new zero-tax bracket for zero-calorie artificially sweetened soft drinks.

Although various beverages will be exempt—e.g., energy drinks (which will bear a separate 100% duty), 100% vegetable/fruit juices, and milk-containing products—virtually all sugared drinks will be impacted.

To businesses, the message is simple: it’s time to act. With early identification and response to such trends, you’re not only remaining compliant but also gaining a jump on a market who is starting to value health decisions more than ever.