UAE Excise Amendment 2025 – Positive & High-Impact Update

The United Arab Emirates implemented excise tax in 2017 as part of strategic measures toward diversifying revenues and reducing consumption of commodities that are harmful. Federal Decree-Law No. 7 of 2017, effective from October 1, 2017, has undergone significant amendments via the Federal Decree-Law No. 19 of 2022, effective October 14, 2022, and the Federal Decree-Law No. 7 of 2025, effective October 1, 2025. These changes refine definitions, expand deductible tax provisions, adjust registration timelines, and introduce statute of limitation rules.

Scope and Taxable Activities

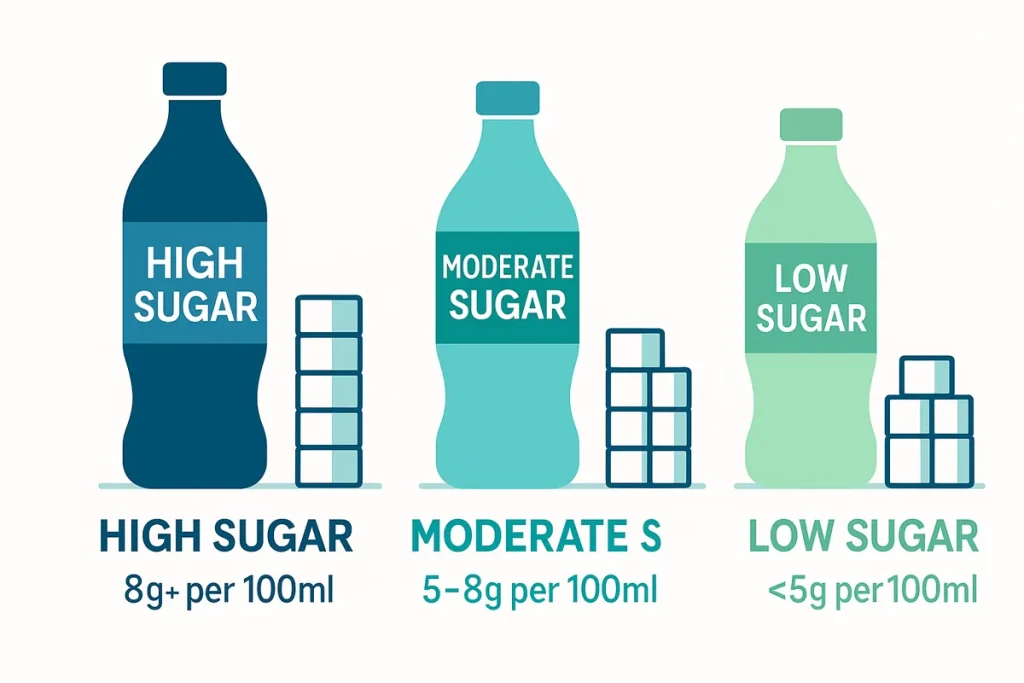

Excise tax applies to goods designated by Cabinet Decision on the Minister of Finance’s recommendation—typically carbonated drinks, energy drinks, tobacco products, and sweetened beverages. Tax is triggered by:

- Production in the UAE (in the course of business).

- Importation.

- Release from a Designated Zone.

- Stockpiling in the UAE (in the course of business).

Tax Rates and Calculation

Rates are set by Cabinet Decision:

- Ad valorem: Up to 200% of the “Excise Price” (a value determined per executive regulations).

- Specific: Up to AED 100 per unit of measurement.

The 2025 amendment raised the ad valorem cap from 100% to 200%, enabling higher duties on high-value items, while capping specific rates at AED 100 (previously uncapped in earlier versions).

Deductible Tax: Expanded Relief

2025 update broadens deductions (Article 16):

- Tax on exported goods.

- Tax on goods incorporated into another taxable excise good.

- Tax on unsold goods if rates decrease (limited to the reduction amount).

- Other cases as Authority-determined.

This allows greater input recovery, particularly for manufacturers and exporters, reducing cascading effects in supply chains.

Registration and Compliance

Prohibited from taxable activities without registration. Primary liable persons (producers, importers, warehouse keepers) must register within 30 days of month-end when activity starts or is intended. Secondary liable parties register upon discovering non-payment.

Exceptions apply for irregular importers or non-business imports, though due tax remains payable. Warehouse keepers for Designated Zones require separate registration.

Designated Zones and Transfers

Fenced free zones meeting criteria are treated as outside the UAE for tax purposes, suspending duty until release. Transfers between zones are tax-free under controlled conditions.

Refunds and Carry-Forwards

Excess deductible tax carries forward to offset future payable tax or penalties; remaining balances are refundable after a set period. Special refunds cover diplomats (with reciprocity), GCC-registered persons exporting to implementing states.

Violations, Evasion, and Limitations

Administrative penalties apply for non-inclusive pricing, zone transfer breaches, or failing to submit price lists.

Tax evasion includes smuggling, handling unpaid goods with intent, false marking, or fraudulent documents punishable.

A new 2022 statute of limitations:

- General: 5 years from tax period end for audits/assessments.

- Extended: Up to 4 years if audit notified timely; 1 year for fifth-year voluntary disclosures.

- Evasion/Non-registration: 15 years.

Record-Keeping and General Rules

Taxpayers keep records of production/import/stock/export and a tax ledger which indicates the amount due/deductible. For certain goods, marks must be affixed showing payment of tax has been made (Decision of the Council of Ministers). The TRN must also be indicated on the correspondence with the Authority.