Depreciation methods for investment properties UAE

Depreciation Methods for Investment Properties: Cost vs. TWDV

Sarah is an enterprising woman based in the UAE who just bought an office building in Dubai that she plans to rent out to businesses. Sarah learned about Ministerial Decision No. 173 of 2025, which enables her to reduce her taxes by claiming a depreciation deduction. But there’s a catch—she must choose between two methods: that based on the Original Cost of the building or the Tax Written-Down Value (TWDV). Confused, Sarah browses the details to find out which method will suit her business best. Here is what she discovered explained in simpler terms for an investor like her.

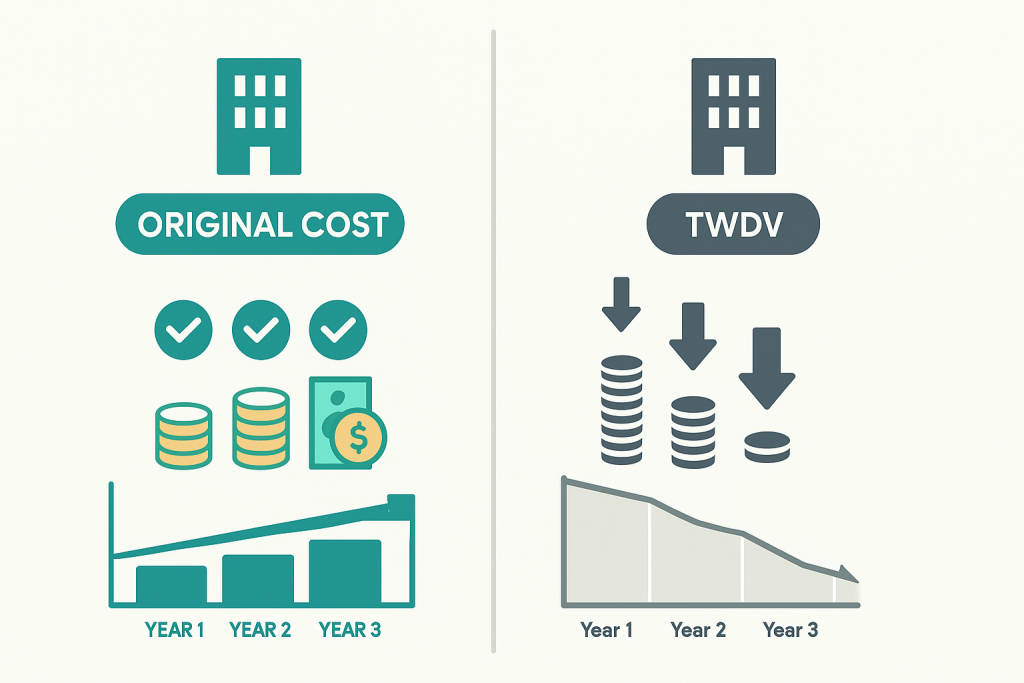

Depreciation on Original Cost

- What It Is: The Original Cost is the amount you spent on the investment property (e.g., a rental or appreciation building), plus any subsequent improvements, brought to fair market value.

- How It Works: You can claim 4% of the Original Cost yearly. For instance, if a property is AED 1,000,000, you claim AED 40,000 per year.

- Feature: The deduction remains fixed every year, as it’s calculated on the original cost, not the current value of the property.

Depreciation on Tax Written-Down Value (TWDV)

- What It Is: The TWDV is the value of the property after deducting all prior depreciation deductions from the Original Cost.

- How It Works: You deduct 4% of the TWDV if it’s lower than 4% of the Original Cost. For example:

- Year 1: TWDV = AED 1,000,000. Deduction = AED 40,000.

- Year 2: TWDV = AED 960,000 (1,000,000 – 40,000). Deduction = AED 38,400.

- Feature: The deduction decreases every year as the TWDV gets smaller.

Comparing

Feature | Original Cost Method | TWDV Method |

Basis | Initial purchase price | Value after prior deductions |

Deduction Amount | Fixed at 4% of original cost | Reduces yearly as TWDV decreases |

Example (AED 1M Cost) | AED 40,000/year (constant) | Year 1: AED 40,000; Year 2: AED 38,400 |

Long-Term Effect | Consistent tax savings | Smaller tax savings over time |

How It Works in Practice

- You claim the lower of the two deductions (4% of Original Cost or 4% of TWDV) every tax year.

- Early, the Original Cost method is generally adopted (because TWDV is equal to the Original Cost initially). Over time, the TWDV method may take over as the TWDV drops.

- On disposal or sale of the asset, the deductions claimed no matter the method must be add back to your taxable income.

Why This Matters

- Tax Impact: The Original Cost method provides steady tax relief, while the TWDV method offers less relief as years pass.

- Decision Point: The depreciation election is irreversible and applies to all your investment properties, therefore be careful in your choice.

- Compliance: Ensure accurate calculations to avoid tax problems, particularly as deductions are reversed when properties are sold.

Next Steps

- Track Values: Monitor your property’s Original Cost and TWDV each year.

- Get Advice: Consult a tax expert to find the optimal strategy for your company.

- Act on Time: Complete the election in the proper tax return, as described in the Decision.