UAE Investment Property Depreciation – 2025 Potential Drawback

UAE issued Ministerial Decision No. 173 of 2025 (effective January 1, 2025) allows businesses to adjust depreciation against investment properties valued at fair value, helping reduce taxes under the UAE Corporate Tax Law.

What is an Investment Property?

An investment property is a building (or part of one) you own or lease to earn rental income, benefit from value appreciation, or both. It does not include land or specific exceptions.

Here’s what investors and business owners need to know:

(a) Investment Property: Buildings held for rental income or value appreciation (not land).

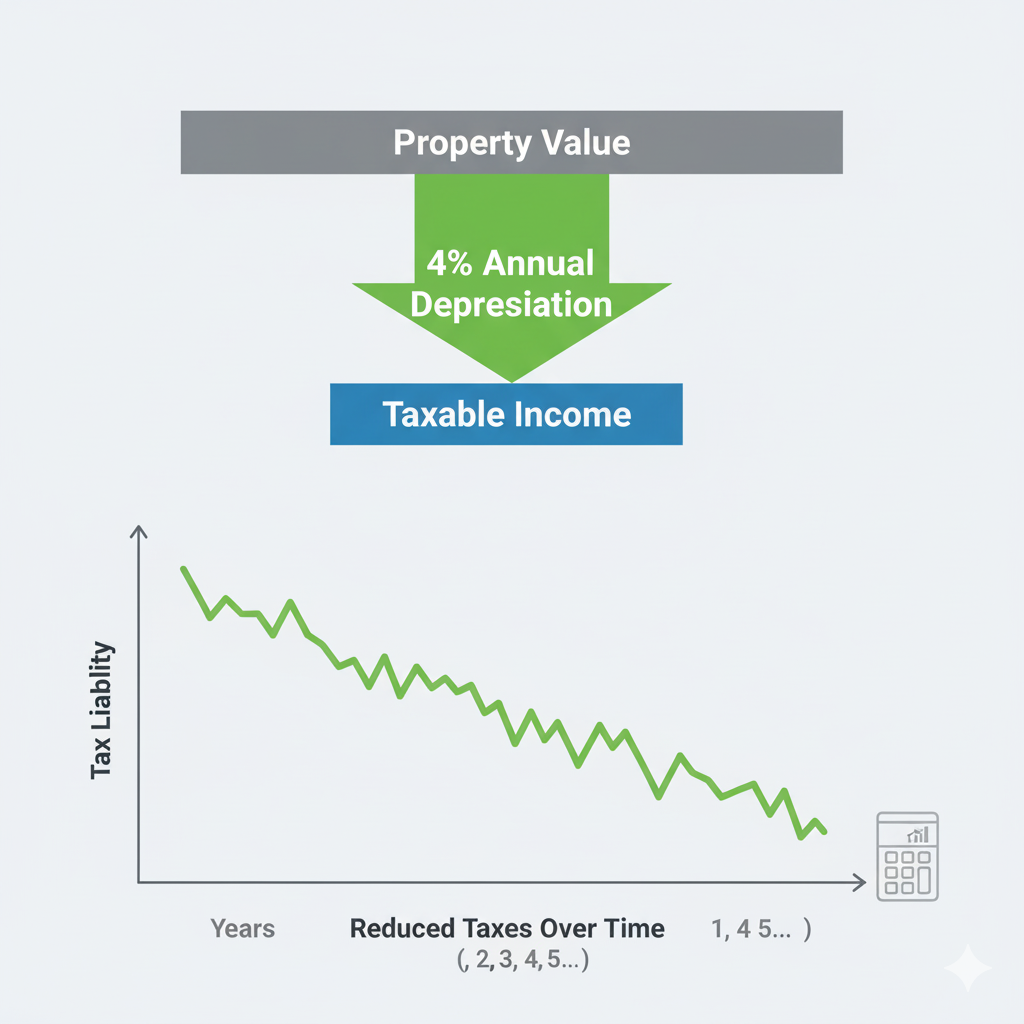

(b) Optional Depreciation: Businesses using accrual accounting can elect a 4% annual depreciation deduction on the property’s original cost or tax written-down value (whichever is lower). This is irrevocable and applies to all investment properties.

(c) Tax Impact: Reduces taxable income each year but has to be added back when disposing or selling the property (except if transferred in a tax group or under certain tax-neutral provisions).

(d) Rules for Transfers: In the event of an intercompany transfer within a tax group or under tax-neutral provisions defined under Articles 26 or 27 of the Corporate Tax Law, the receiving company (transferee) cannot claim depreciation on amounts already written off by the seller (transferor) to prevent double-dipping on tax benefits. In the future, if the transferee sells the asset, the taxable income of the transferee should be adjusted for any depreciation previously being excluded.

(e) Deadlines: Elect in the tax return for:

- First tax period starting on/after January 1, 2025, if you hold investment properties.

2. The period you acquire your first investment property.

3. The first period after an Article 21 exemption ends.

(f) Anti-Abuse Rule: Tax authorities can disallow deductions for related party transfers with no valid business purposes.

(g) Action Steps:

- Review your investment properties.

2. Consult with professional to decide on the election.

3, Make the election in the appropriate tax return.

Need Support?

Not sure if you’re eligible? Or confused about the deadline?

Get in touch with our team today — we’ll make it simple.